Family Offices can benefit from Hong Kong’s tax exemption proposal

12 September 2022 - Hong Kong is currently considering a change in its tax rules, which could create a more attractive environment for family offices to be set up and ran from the country.

The Financial Services and Treasury Bureau (FSTB) submitted a paper for discussion in April 2022 to the Legislative Council Panel on Financial Affairs around the subject of Proposed Tax Concession for Family Offices.

The objective of the proposed tax exemption is to provide tax certainty to ultra-high-net-worth individuals and their family members who hold assets via investment holding vehicles, in order to attract family offices to set up and operate in Hong Kong.

The tax exemption is aimed at family-owned investment holding vehicles (FIHV) managed by Single Family Offices (SFOs) in Hong Kong, and it is expected to apply from year of assessment 2022/2023. In terms of substantial activity requirements, the core income generating activities (CIGAs) with respect to the asset management must be performed in Hong Kong.

The requisites for the FIHVs to qualify for this tax exemption include – but are not limited – to:

- The FIHV must be a corporation, partnership, or trust set up in or outside Hong Kong with the central management and control located in Hong Kong.

- The assets of the FIHV must be managed by a SFO in Hong Kong.

- The aggregate average value of assets under management for a family-owned structure (either a single FIHV or multiple FIHVs) needs to be at least of HKD240 million (just over USD30 million).

- The FIHV must only serve as an investment vehicle for holding and administering the assets of the single family and must not directly engage in activities for general commercial or industrial purposes.

- The FIHV must be exclusively and beneficially owned by one or more individuals who are “connected persons” of the same family (“single family”).

If these are met, the FIHV is allowed to set up special purpose entities to hold and administer the specified assets. However, it also needs to employ at least two full-time qualified employees in Hong Kong and incur a minimum of HKD2 million yearly (around USD 250k) in operating expenditure to carry out the CIGAs.

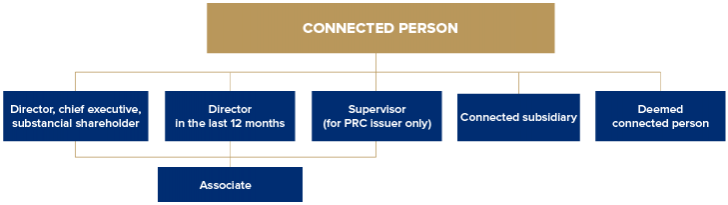

“Connected Persons” has a broad definition covering multiple generations, including:

i. A director, chief executive or substantial shareholder (holding 10% or more of the voting rights) of the listed issuer or any of its subsidiaries, or an associate of any such persons;

Persons connected with the listed issuer’s “insignificant subsidiaries” are not connected persons. An “insignificant subsidiary” is a subsidiary of the issuer whose total assets, profits and revenues are less than:

- 10% under the percentage ratios for each of the three preceding financial years; or

- 5% under the percentage ratios for the latest financial year.

ii. A person who was a director of the listed issuer or any of its subsidiaries in the past 12 months, or an associate of such a person;

iii. Or a connected subsidiary

Although not discussed in detail in the consultation paper, the scope of “qualified transactions” in specified assets is expected to be similar to that under the existing unified tax exemption for funds, which is broad enough to cover the typical asset types that family offices are investing in.

Hong Kong as a family office hub

The growth of family offices is a global phenomenon and Asia has recently outpaced the rest of the world in their creation – roughly 40% of family offices have been established since 2010 in the region. At present, China has the second highest number of billionaires in the world, behind only the US, with numbers rising fast.

Hong Kong is already well regarded as an international financial services center. The new legislation clearly aims to make it more competitive as an asset management hub – helping to expand its wealth management industry by encouraging more wealthy families to invest in and throughout it.

This initiative will also deepen Hong Kong's funding pool, and create more business opportunities for the financial services industry.

As experts in entity life cycle management, Citco Corporate Solutions pragmatically supports Family Offices, Corporate and Fund clients in need of such services both in Hong Kong and around the world.