Depositary Services

The Citco group of companies (Citco’s) Depositary Services offers tailored solutions for asset safekeeping, cash flow monitoring, and regulatory oversight, supporting a wide range of alternative investment funds across key European financial centers.

Strengthening fund operations: Your partner in regulatory compliance and investor protection

Citco's Depositary Services combine local expertise with global best practices, ensuring your funds meet the highest standards of transparency and security in line with AIFMD requirements.

Depositary Services: Providing diligence and efficiency in fund oversight.

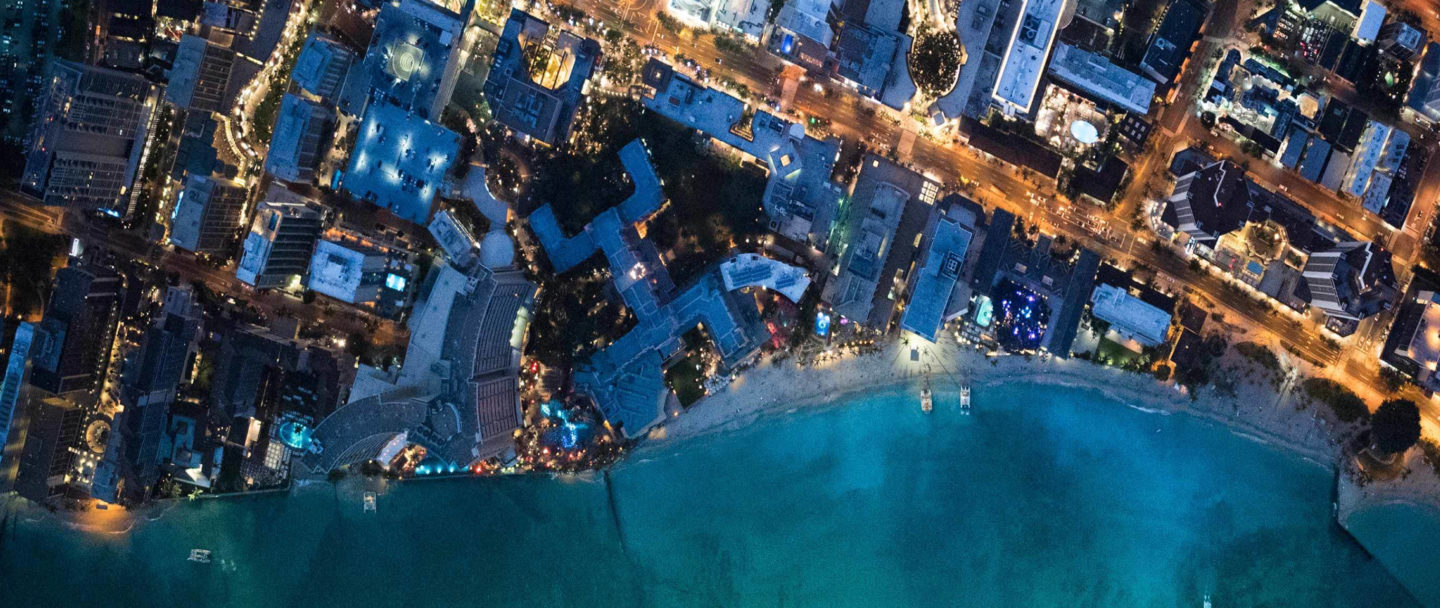

Delivering bespoke depositary solutions for fund structures across strategic European locations.

European Depositary Services

Citco’s Depositary Services operates from key financial hubs in Ireland, Luxembourg, the United Kingdom, and Malta, serving as a cornerstone of fund integrity and regulatory compliance. Our comprehensive suite of services is tailored to meet the evolving needs of alternative investment funds (AIFs) and other collective investment schemes across Europe. Our offering centers on three critical functions: safekeeping of financial instruments and other assets, meticulous cash flow monitoring, and rigorous oversight. These services are customized to align with specific regulatory requirements and the unique characteristics of each fund structure we serve.

AIFMD Compliance

In Ireland and Malta, we specialize in servicing authorized AIFs and non-EU AIFs operating under the AIFMD framework. Our Luxembourg arm caters to a diverse range of open and closed-ended fund structures, including Part II Funds, SIFs, SICARs, RAIFs, ELTIFs and AIFs structured as Limited Partnerships. In the UK, we focus on unauthorized UK AIFs.

Across all locations, our services adhere strictly to AIFMD standards, ensuring the highest levels of regulatory compliance and investor protection. By choosing Citco, fund managers gain a partner committed to enhancing fund integrity, transparency, and operational efficiency.

Our blend of local expertise and global perspective uniquely positions us to navigate the complexities of fund oversight. This allows our clients to focus confidently on their core investment strategies, knowing their regulatory and operational needs are in expert hands.