Changes to Hong Kong’s Foreign Source Income Exemption Regime

23 December 2022 - Hong Kong has introduced a new Bill designed to ensure any taxpayer benefitting from preferential tax treatment in the jurisdiction has a substantial economic presence there.

The Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Bill 2022, which proposes amendments to Hong Kong's foreign-sourced income exemption (FSIE) regime, was gazetted on 28 October 2022 following a long negotiation with the EU, and a consultation with various stakeholders.

The Bill proposes that specified foreign-sourced income would be deemed taxable in Hong Kong, unless certain conditions are met. Subject to legislative procedures, the new FSIE regime would become effective from 1 January 2023.

What is the Impact?

The change in Hong Kong’s FSIE regime will enable the region to keep up with the latest international tax standards. Based on the proposal, it is likely that the new FSIE regime would affect the taxability of interest income received from overseas related companies by a Hong Kong intermediate holding company, if the company cannot fulfill the economic substance requirements.

Once the legislation process is completed, administrative guidelines will be issued by the Hong Kong Inland Revenue Department to clarify the application requirements in more details. Citco Corporate Solutions companies will closely monitor this matter and provide additional comprehensive services to assist our clients in navigating the relevant economic substance requirements in respect of this new tax legislation.

What is changing? Previous regulation regarding taxation of foreign income in Hong Kong

According to the current taxation rules, only income sourced from Hong Kong is subject to profits tax in Hong Kong. This means offshore passive income such as dividends, disposal gains in relation to shares or equity interest, interest income, or income from intellectual properties ("IP") is exempted from profits tax.

Proposed changes on offshore passive income

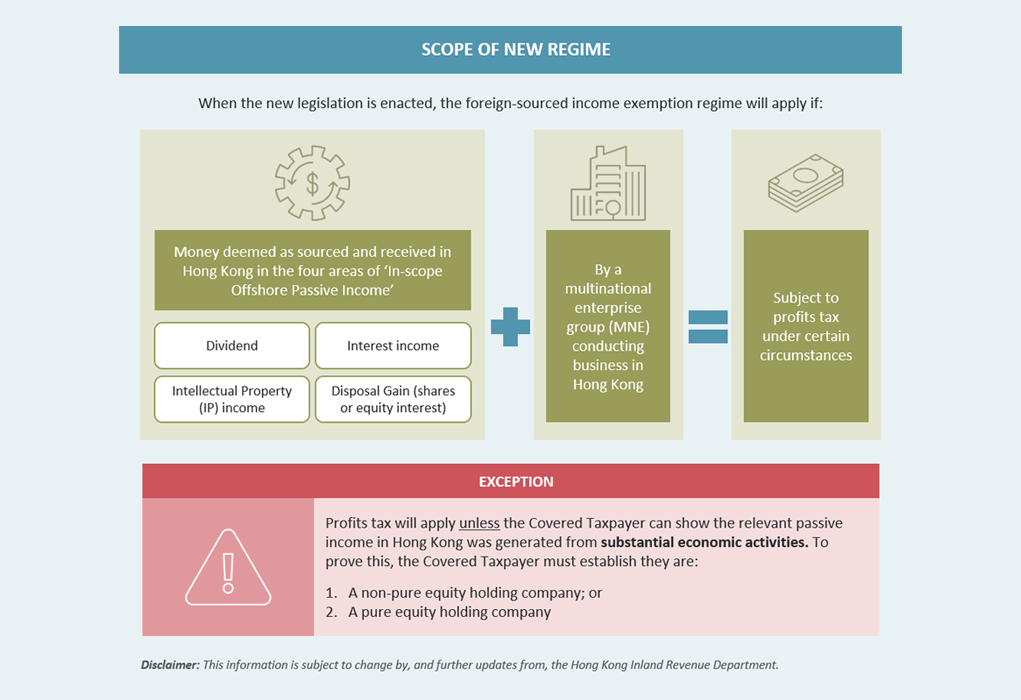

Under the new proposed FSIE regime, four types of offshore passive income - dividends, disposal gains in relation to shares or equity interest, interest income and income from IP (collectively known as "in-scope offshore passive income") - would be deemed sourced from Hong Kong and subject to profits tax under certain circumstances.

Overview of the Proposed Refined FSIE Regime

Covered income criteria

- Dividends, disposal gains in relation to shares or equity interest, interest income and income from IP;

- Received in Hong Kong;

- By a constituent entity of an multinational enterprise group (MNE) (a “Covered Taxpayer”); and

- The Covered Taxpayer fails to meet the relevant economic substance requirement or nexus approach requirements.

Covered taxpayer criteria

The proposed refinements will only apply to multinational enterprise groups. These are defined under the Global Anti-Base Erosion Rules, promulgated by the Organization for Economic Co-operation and Development as “any group that includes at least one entity or permanent establishment that is not located in the jurisdiction of the ultimate parent entity”.

Hence, the proposed refinements are not applicable to:

- Stand-alone local companies;

- Purely local group companies; or

- Individuals.

Received in Hong Kong criteria

The relevant income would be regarded as received in Hong Kong when such income is:

- Remitted to, or is transmitted or brought into, Hong Kong;

- Used to satisfy any debt incurred in respect of a business carried on in Hong Kong; or

- Used to buy movable property, and the property is brought into Hong Kong.

Economic Substance Requirements for Non-IP income

Non-IP passive income including interest income, dividends and disposal gains would not be deemed sourced from Hong Kong and subject to taxation in Hong Kong if the taxpayer conducts substantial economic activities in relation to the relevant passive income in Hong Kong.

In order to avoid taxation, the following requirements need to be met:

1. NON-PURE EQUITY HOLDING COMPANY:

- Substantial economic activities have to be conducted, including making necessary strategic decisions, or managing and assuming principal risks in respect of any assets it acquires, holds, or disposes of.

2. PURE EQUITY HOLDING COMPANY:

- Primary function is acquiring and holding shares or equitable interests in companies and only earns dividends and disposal gains in relation to shares and equity interests.

- A reduced substantial activities test would be applied.

- Relevant activities would only include holding and managing its equity participation, and complying with the corporate law filing requirements in Hong Kong.

The activities are not required to be carried out by an organization itself. Outsourcing of relevant activities would be permitted if the taxpayer can demonstrate adequate oversight of the outsourced activities and that the relevant activities are conducted in Hong Kong.