Private markets payouts rise in 2025 - Citco looks at latest DPI trends

Private markets distributions have climbed again in 2025 as managers continue to focus on returning capital to investors.

As funds do their best to navigate a difficult returns environment in the current era of low liquidity, there has been a general shift in the market to reward managers of funds with both high Internal Rate of Returns (IRRs) and Distributed to Paid-in Capital ratios (DPIs), versus those with strong performance but lower distributions.

With liquidity still constrained by a lack of dealmaking due to macro events such as trade wars and tariffs, this focus on distributions has only intensified, with managers that have achieved higher DPIs being rewarded via successful subsequent fundraises.

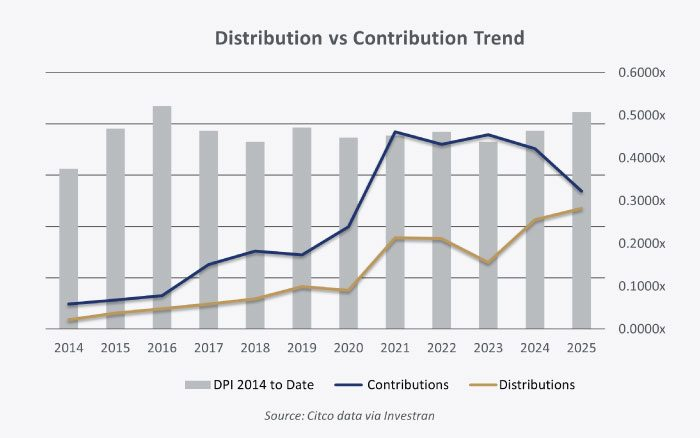

Data from the Citco group of companies (Citco) - which administers almost $3trn of assets across private assets, hedge funds and other alternative investments - shows this focus on DPIs has continued in 2025, with the YTD DPI (to end of September) rising to 0.88x, another significant jump versus the same period last year when they stood at 0.61x. Looking across the last ten years, on a cumulative basis, YTD DPI has risen to 0.51x in 2025, another significant jump from last year’s figure of 0.46x, and the highest level since 2016 when it stood at 0.52x.

The data supports the notion that distributions are of increasing importance to LPs, as does the trend playing out in terms of the distribution/commitment ratio which has also been consistently increasing, but there remain other concerns.

Contributions fell 24% year-on-year in 20251, to leave them adrift of the highs seen in the early part of the decade. Growth in NAVs and AUM continued in 2025, but this growth was lower than previous years, at 8% and 9% respectively, versus the double-digit growth seen consecutively in the last 10 years.

In the current environment, liquidity is a central focus for GPs trying to satisfy the demands of LPs, so the further rise in DPIs this year is welcome. There is still caution in markets, and this is reflected in lower contributions, as longer holding periods and more subdued dealmaking weigh on confidence, but crucially, the industry is responding.

Increasing DPIs highlight this renewed focus on investor outcomes, with IRRs alone no longer enough to satisfy investors, so we expect to see increasing innovation from managers as they respond to the shift in market dynamics.

1 On an annualized basis